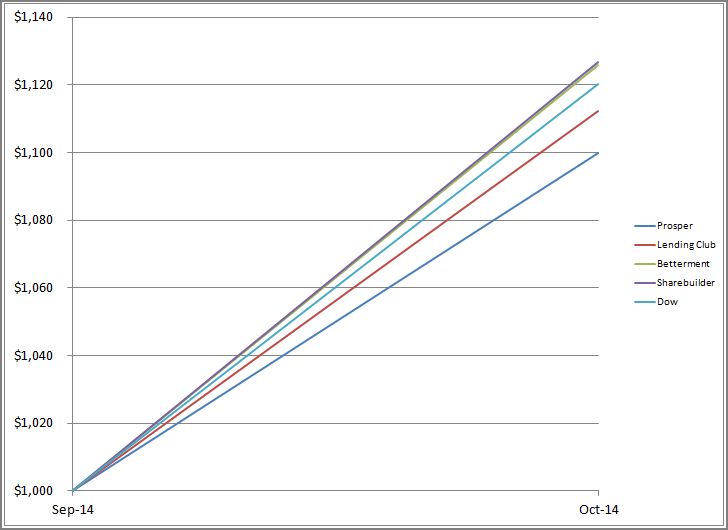

In September, I decided I needed to step up my savings game a little bit and wanted to try out 4 investment options to see how they compare over time. So, October 1st, I deposited $1,000 into each account and started contributing $100 a month. Here are the results after the first month. Just remember, this is a marathon, not a 100-meter sprint… so, just because something is performing better than another after 31 days, doesn’t mean it will be the best thing over the long-term, especially when you factor in your unique circumstances.

In This Post

The $1,000 Investment Challenge

- An Introduction – Where to invest $1000 – my investment challenge

- Investing with Prosper peer-to-peer lending

- Investing with Lending Club peer-to-peer lending

- Investing with Betterment

- Investing with Sharebuilder

How did the market perform in October 2014?

October 2014 was a relatively wild month in the stock market. During the 2nd week of October, everyone went crazy and thought that the world was ending with the ISIS and Ebola scares, so the market sold off in a big way. The Dow went from a 1% gain for the month on October 8th, to a 4% loss on October 16th.

If you’re a smart investor who is following your long-term plan, you would have seized on this opportunity and bought more! If you have a short-term horizon for your investments, my opinion is that you shouldn’t be playing with the market because of fluctuations like this.

Regardless, the Dow ended up 3.5%, the S&P was up 3.7%, and the NASDAQ was up 4.7%.

How did my investments perform in October 2014?

All investments were positive for the month, except for Prosper which did not move at all since the loans invested in have taken time to get funded.

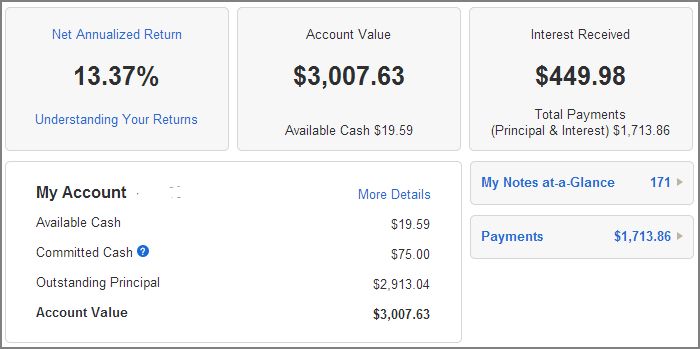

Lending Club

Because I had an existing account with Lending Club, I am making a manual adjustment for my existing balances to normalize to the $1,000 investment that the other options received. There is still an advantage for Lending Club over Prosper because the notes invested in are already funded from Day 1.

Click here to open an account with Lending Club.

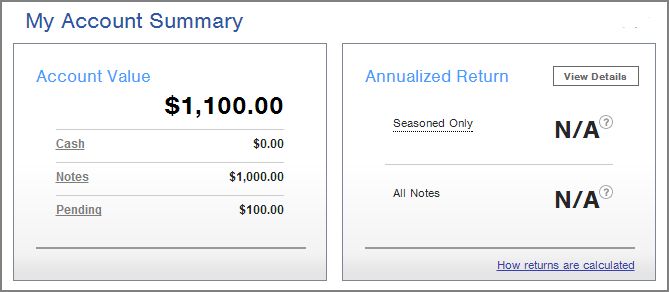

Prosper

Through October, the $1,000 was invested in several notes, but they had not funded by October 31. So, the balance was only the $1,000 initial investment plus the $100 monthly contribution.

As you can see here, there were a wide variety of notes selected, but the 40 notes for $25 each are still in the funding stage.

Click here to open an account with Prosper.

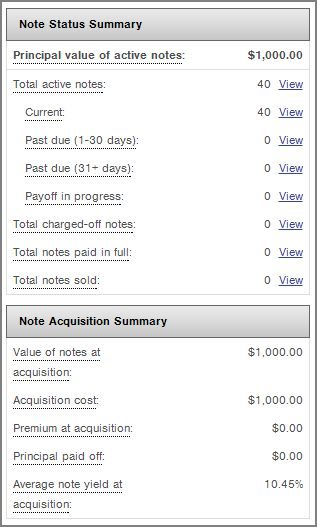

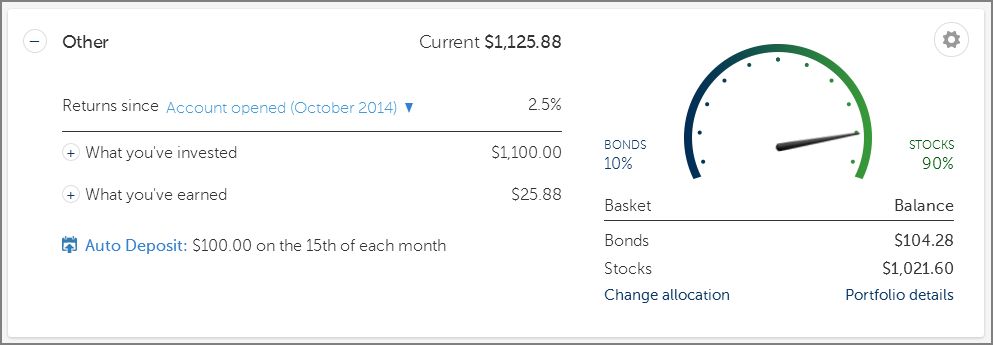

Betterment

My Betterment investment is performing well. I am maintaining the 90/10 split between stocks and bonds, as you can see below. The timing of the additional $100 investment on the 15th worked out well since that was the bottom of the October market dip.

Click here to open an account with Betterment.

Sharebuilder

In my Sharebuilder account, I am investing in the USAA First Start Growth (UFSGX) fund because it is a no-fee option and has a mix of stocks and bonds, otherwise known as a balanced fund. The Sharebuilder account’s performance is boosted because there was a sign-up bonus of $50. The $50 bonus was invested in early November, so it isn’t reflected in the balance below.

Click here to open an account with Sharebuilder. They often provide bonuses when you sign up, so I would hold off until you find a bonus that fits your objectives. Also consider opening an online savings account with CapitalOne360… there are no minimums or monthly fees.

How do the performances compare to each other?

One of the main purposes of this investing experiment is to compare their performances against each other. The stock-based options of Betterment and Sharebuilder are not only in the lead, they both beat the Dow in the month of October.

I keep track of all of my investments using the free online management tool, Personal Capital. It allows you to track a wide variety of accounts, such as your 401(k), IRA, bank accounts, brokerage accounts, and real estate. Click here to sign up for Personal Capital.

Conclusion

It’s only been one month, but I’m satisfied with the early results. My stock-based positions are performing well, while the peer-to-peer lending options are a good alternative to bonds in your portfolio. I’m looking forward to seeing how November’s results are, including the funding of my first Prosper notes.

Join Our Newsletter

Join the BaldFinance.com newsletter to stay up-to-date with the latest news, specials, promo codes, and interesting stories about personal finance.